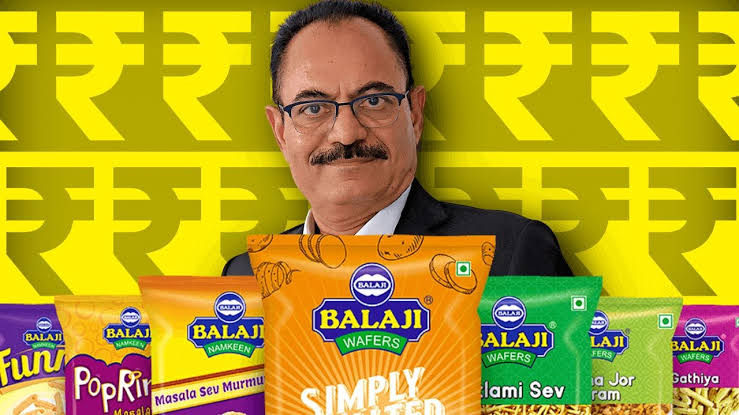

Balaji Wafers, the iconic Gujarat-based snack maker, is in advanced talks with top private equity firms to sell up to 10% stake. The deal, pegging the company at a ₹40,000 crore ($4.8 billion) valuation, signals a golden moment for investors seeking exposure to India’s fast growing FMCG sector.

The stake sale, expected to raise around ₹4,000 crore, is structured to include both a primary infusion fresh capital to accelerate growth and secondary sales, offering liquidity to promoters. For investors, this opens the door to a rare high-growth, high-profit consumer brand with strong fundamentals and long-term scalability.

Balaji’s financials underscore its strength. Revenue in FY24 touched ₹5,453.7 crore, growing 10.7% year-on-year, while profit after tax surged 41.4% to ₹578.8 crore. With profitability expanding faster than revenue, the company demonstrates operating leverage that serious investors value. Compared to listed peers like Prataap Snacks (₹2,379 crore market cap) and Bikaji Foods (~₹20,000 crore market cap), Balaji’s valuation premium appears well justified.

The funds raised will fuel expansion across manufacturing, distribution, and product innovation. Scaling capacity, deepening presence in Tier-II and Tier-III markets, and strengthening marketing efforts position the company for sustained growth. Importantly, the Virani brothers have indicated openness to professionalizing management, a step that often enhances governance and institutional investor confidence ahead of an IPO.

Sector tailwinds further strengthen the case. India’s packaged food market, valued at $121.3 billion in 2024, is projected to nearly double to $224.8 billion by 2033 at a 6.5% CAGR. Savory snacks, one of the fastest-growing categories, benefit from urbanization, rising disposable incomes, and rural penetration. Haldiram’s $10 billion valuation has set a benchmark, and Balaji armed with strong regional dominance, aggressive pricing, and powerful brand recall appears poised to ride the same wave.

For investors, the takeaways are clear. Balaji combines strong brand equity with expanding profitability, significant headroom for growth, and a medium-term IPO horizon. With promoters preparing for a potential listing in the next five to six years, today’s stake sale could mark the perfect entry point for private equity players and signal to public market investors that the countdown to a blockbuster IPO has already begun.

Balaji Wafers is not just another snack company it is an FMCG growth story unfolding. At a ₹40,000 crore valuation, with robust financials and a sector set for sustained expansion, it represents one of the most compelling opportunities in India’s consumer boom.